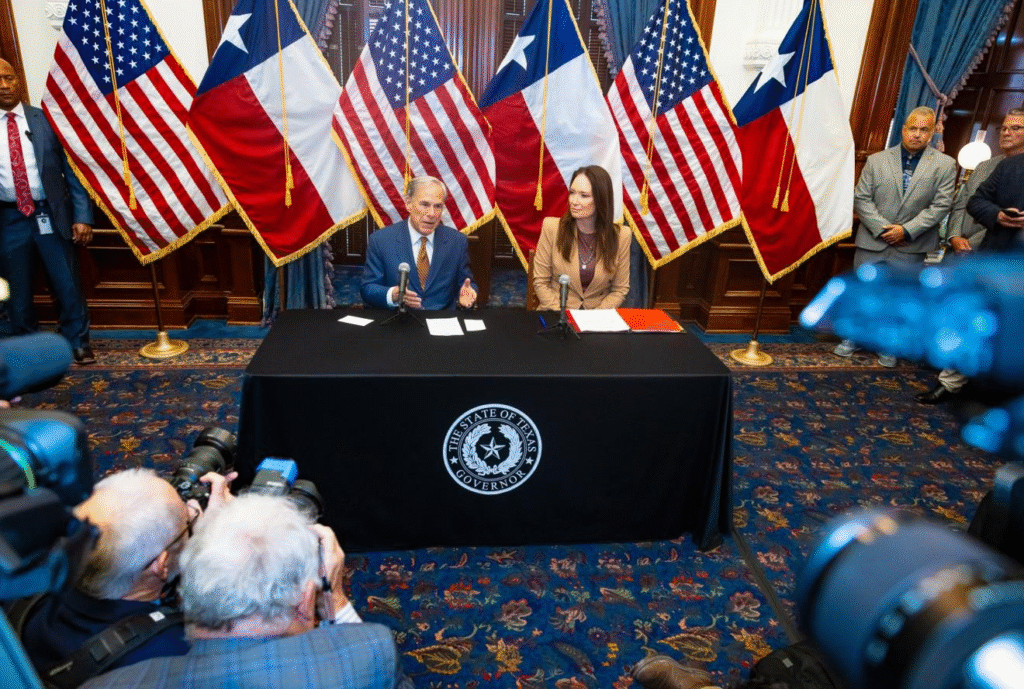

On August 15, in McAllen, TX, U.S. Agriculture Secretary Brooke Rollins unveiled a “sweeping plan” to stop the New World Screwworm (NWS) from crossing into Texas — headlined by a $750 million sterile-fly plant in Edinburg capable of producing 300 million flies/week. Minutes later, Meriwether Farms lit up X in response, blasting the announcement as a packer-friendly delay while the parasite inches north.

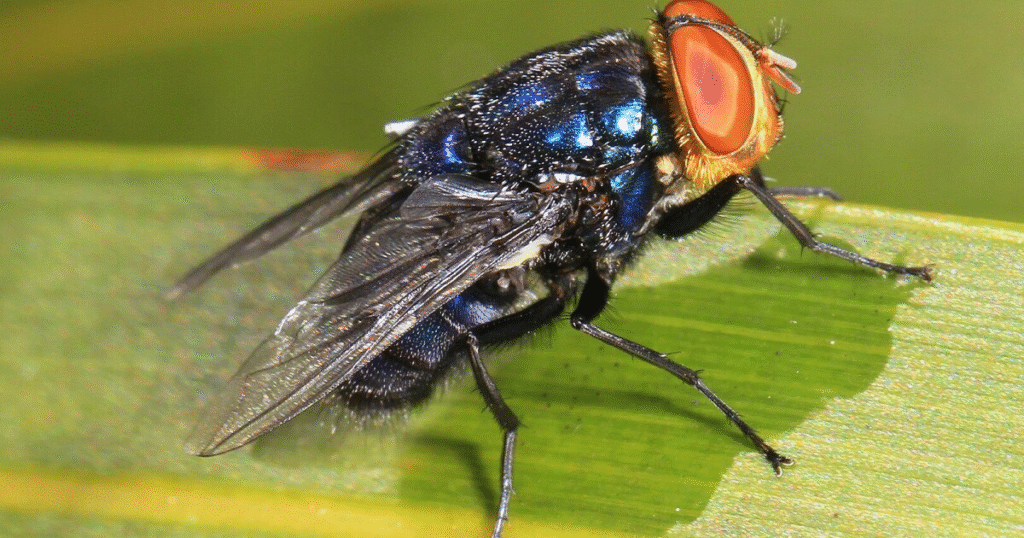

The Parasite — and the Stakes

The New World Screwworm (Cochliomyia hominivorax) was eradicated from the U.S. in 1966 using the Sterile Insect Technique (SIT), which releases irradiated males until the population collapses. A joint U.S.–Panama barrier (COPEG) has held the line ever since. USDA also wiped out a Florida Keys outbreak in 2016–2017 the same way.

That barrier broke in 2022. The pest surged north through Central America, hitting Mexico by late 2024. As of August 2025, there are 2,700+ confirmed cases in southern Mexico — Oaxaca, Veracruz, and Chiapas among the worst hit — and the nearest outbreak sits less than six hours from the Texas line.

Unchecked, NWS can kill untreated livestock within days. The Texas cattle industry is worth $15 billion; a U.S. outbreak could cost billions annually, push herds to record lows, and spike meat prices for consumers.

Policy Whiplash

Rollins’ timeline reads like a biosecurity yo-yo:

- May 11: USDA suspended all live animal imports from Mexico.

- June 30: USDA partially reopened ports to “low-risk” states like Sonora and Chihuahua.

- July 9: USDA closed them again after fresh detections in Veracruz.

The August 15 USDA plan adds the Edinburg factory, $100 million for trap/lure/therapeutic R&D, $21 million to renovate a Mexican plant, $8.5 million for a Moore Air Base dispersal center, plus more border “tick riders” and detector dogs. Smart — but SIT works best before wild populations explode, and the clock is ticking.

Big Packers in the Shadows

Tyson Foods and JBS — alongside Cargill and National Beef — dominate U.S. slaughter capacity and poured money into D.C. while the border policy swung. In 2025, Tyson has spent $1.09 million and JBS $1.546 million on lobbying, targeting trade, ag policy, and immigration. Tyson has told investors Mexican flows hit U.S. cattle prices; JBS runs deep supply lines in Oaxaca, Veracruz, and Chiapas — now NWS hot zones.

Here’s the kicker: outbreak zones overlap cartel smuggling corridors. InSight Crime has documented the Central America-Mexico cattle-laundering pipeline into Veracruz since 2022, and they warned last fall that NWS hotspots mirror those routes. Reuters reported Mexican ranchers are begging the government to crush illegal cattle smuggling they blame for the surge.

JBS’s record doesn’t help: parent company J&F Investimentos pleaded guilty in 2020 to a billion-dollar bribery scheme involving 1,800 Brazilian politicians — cash that fueled U.S. acquisitions like Swift & Co. and Pilgrim’s Pride. Add recent child-labor violations and persistent “Product of USA” labeling games, and ranchers are openly asking why USDA contracts and taxpayer dollars keep flowing.

No leaked memo proves Tyson or JBS demanded the June 30 reopening — but the timing, the money, and the corridors line up a little too neatly for producers living with the fallout.

Ranchers Turn to DHS as USDA Loses Credibility

Meriwether’s post-presser blast didn’t just rip the timeline; it called for Department of Homeland Security oversight. DHS already helps lead U.S. ag-biosecurity efforts for transboundary livestock threats. Agriculture pumps $1.1 trillion into the U.S. economy — plenty of reason for DHS to treat NWS as a cross-border risk, not a niche vet problem.

On the Hill and in the industry, the split is stark: NCBA, AFBF, and Texas Farm Bureau cheered today’s plan; producers on the line say a year to spin up the factory is too slow when the parasite is already pressing north.

The bigger fight (and the fix)

If NWS crosses, small ranchers will be first to absorb treatment costs, quarantines, and herd losses — paving the way for more packer consolidation. That means higher prices for families and more leverage for the plants.

Do this now:

- Over-supply sterile flies via Panama/Mexico facilities while Edinburg is built.

- Hammer illegal cattle trafficking routes with joint U.S.–Mexico ops; track and trace cattle as seriously as fentanyl.

- Pair biosecurity with market integrity: revive Mandatory Country of Origin Labeling and push antitrust enforcement so consolidation doesn’t turn a pest into a monopoly dividend.

”They can sterilize flies in Texas. What they can’t sterilize is the lobby money coming out of Tyson and JBS.” — RS June, Editor-in-Chief, Beef News

USDA finally moved. Now it has to move faster than the fly — and a lot faster than the lobbyists.

0 Comments