You’re not imagining it—your steak is getting more expensive. But what the headlines aren’t telling you is why.

The U.S. cattle industry is heading off a supply cliff, and the bottom is nowhere in sight.

According to the USDA’s May 2025 Livestock, Dairy, and Poultry Outlook, beef production is projected to decline by nearly 2% in 2025, dipping to 26.6 billion pounds. This marks the third consecutive year of decline, the steepest sustained drop since the 1980s. The reasons are structural: a historic liquidation of the national cow herd, extreme droughts, sky-high feed prices, and multi-generational ranch exits.

Heifer retention—essential to rebuilding the herd—remains at a 30-year low. The January 1 cattle inventory stood at 86.7 million head—the lowest since 1951—marking the sixth consecutive year of contraction. With pasture conditions still recovering and input costs outpacing market returns, ranchers aren’t rebuilding anytime soon.

This isn’t just a blip—it’s the start of a supply chain contraction that could last well into 2026 and beyond. The long biological cycle of cattle production (18+ months from calf to carcass) means the decisions ranchers are making today will be felt on your dinner plate for years to come.

So who benefits?

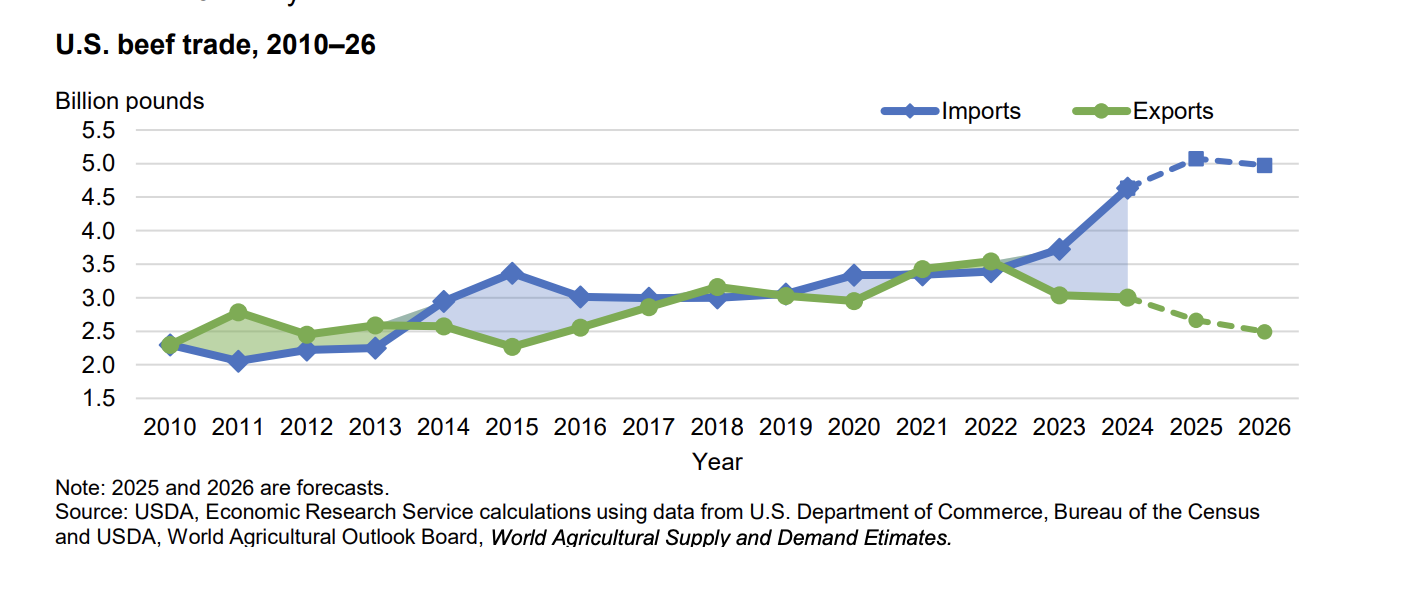

The Big Four meatpackers—Tyson, JBS, Cargill, and National Beef—are already importing more beef from countries like Brazil and Uruguay to fill the gap. Imported beef labeled “Product of USA” is still legal through 2026, thanks to USDA loopholes. Meanwhile, investors in lab-grown meat and synthetic proteins are aggressively marketing themselves as the “solution” to a problem they never had to solve.

And the ranchers? They’re squeezed at every turn—dealing with rising land prices, regulatory pressure, and a market increasingly designed to phase them out. The USDA’s own Economic Research Service recently warned that rancher profit margins will tighten in 2025, even as retail beef prices hit record highs.

If this all sounds like engineered scarcity, you’re not far off.

This is the playbook of every cartel: reduce supply, maintain control, and manipulate the consumer narrative. The cattle cliff isn’t just a market correction—it’s a consolidation event. One that clears the way for foreign imports, synthetic alternatives, and fewer independent producers in the middle.

We’re watching the slow-motion demolition of U.S. beef infrastructure—and unless something changes fast, rebuilding may not be possible.

Support your local rancher directly by visiting BeefMaps.com

0 Comments